There are plenty of identity theft companies to consider, and they generally offer similar features with some exceptions.

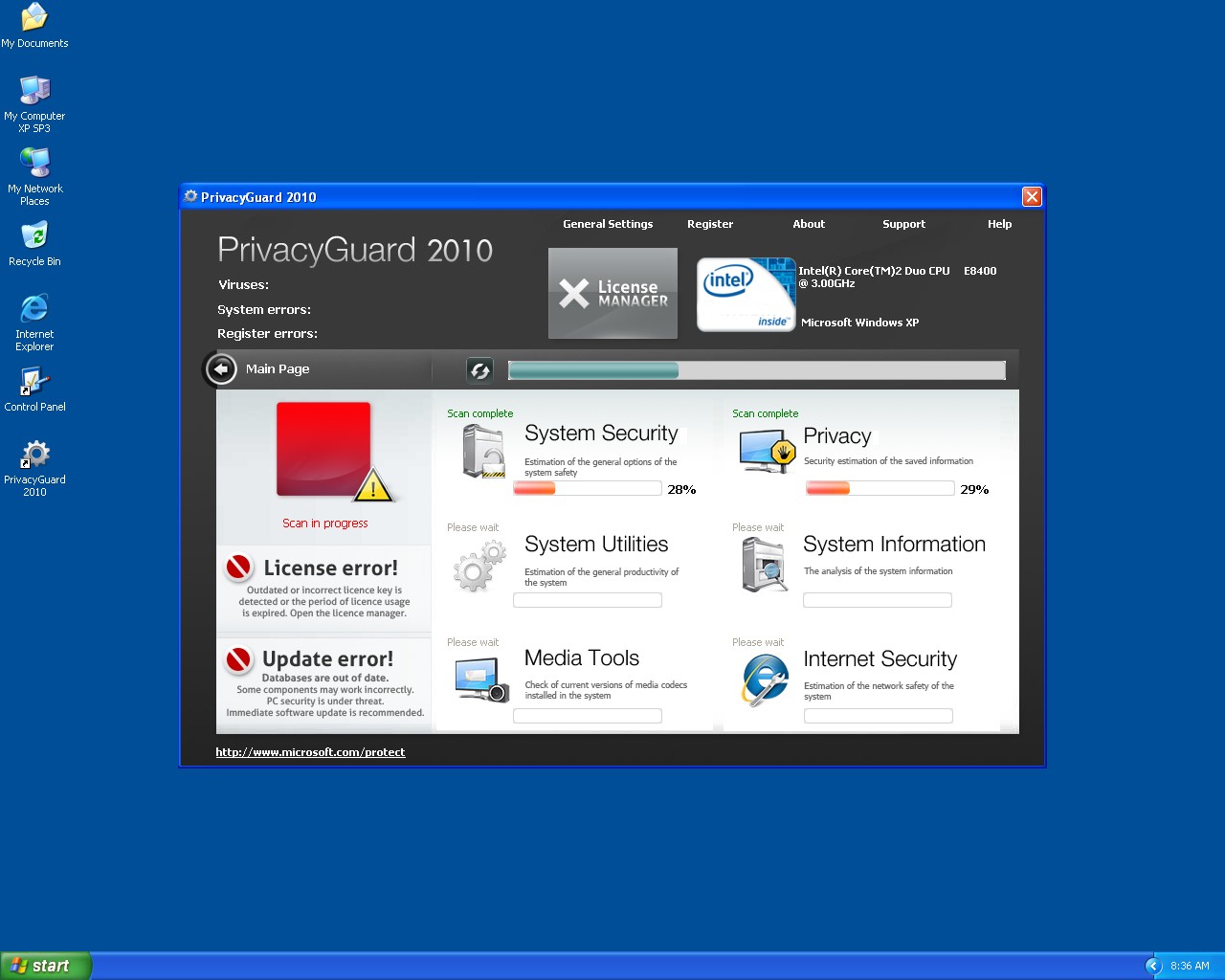

#PRIVACY GUARD SCAMS PLUS#

Up to $1 million, plus up to $500,000 in reimbursement for stolen funds from a 401(k) or HSAĪt least 1 bureau monitoring comes with all plans $14.95 to $19.95 per month for individuals $9.99 to $29.99 per month for individuals $8.99 to $29.99 per month for individuals Some Identity Guard plans include monitoring for all three credit bureaus, which can alert you to some of the first signs of fraud. Monitoring your credit reports and your score.You can pay for the amount of monitoring you need, and you can spend your time doing something else. Identity Guard will take the task of overseeing your financial accounts off your plate. Financial accounts monitoring and notification of any changes.A 2019 identity theft study from Javelin Research revealed that three times as many people faced financial losses due to identity theft in 2018 when compared to 2016.

All plans come with $1 million in identity theft protection, which is an important consideration since a growing number of people are personally paying out of pocket for fraud. Insurance against covered financial losses resulting from identity theft.If you decide to sign up for Identity Guard, here are the main perks you can look forward to: While there are steps you can take to protect your identity without paying a third party for help, many people find that the peace of mind identity theft protection provides makes the cost well worth it. You don’t have to use the app, but it’s available if you prefer to monitor your identity via mobile instead of a desktop computer. Identity Guard also comes with a mobile app that lets you oversee your identity and receive notifications on the go. This insurance alone could be worth the price of admission, but you can pay more to have more of your personal finances and accounts overseen. Note that all plans from Identity Guard come with $1 million in identity theft insurance that will reimburse you for covered financial losses if your identity is stolen or compromised. Ultra identity theft monitoring from Identity Guard includes their broadest selection of benefits including 401(k) and investment account monitoring, credit and debit card monitoring, home title monitoring, address change monitoring and more. The Ultra plan is the most expensive, but it’s best if you have a complicated financial situation and plenty of assets.

#PRIVACY GUARD SCAMS UPGRADE#

However, you’ll have to upgrade to their Total or Ultra plan if you want any sort of credit monitoring and if you want bank account monitoring or any oversight on additional financial accounts you have. Their value plan includes basic identity monitoring, data breach notifications, dark web monitoring, credit protection tools and other benefits. Identity Guard plans are offered in three tiers for individuals or for families - Value, Total and Ultra.

Identity theft protection from Identity Guard can help you proactively avoid losing money or your time and energy by spotting signs of fraud early on. When you’re a victim of identity fraud, you have to spend your own resources trying to dig your way out. All Identity Guard plans come with $1 million in identity theft insurance that can reimburse you if you face covered financial losses due to identity fraud or theft. This company offers individual and family identity monitoring plans that include protective benefits like dark web monitoring, data breach notifications and credit report tracking. Identity Guard is a top provider in the identity theft protection space. While you can take myriad steps on your own to avoid becoming a victim of fraud, identity theft monitoring companies take on the grunt work for you by monitoring your accounts and taking actionable steps to protect you around the clock. Becoming a victim of identity theft can be a costly, traumatic experience, which is why savvy consumers take steps to keep their information out of the hands of hackers and thieves.

0 kommentar(er)

0 kommentar(er)